Author: Mr David Morris, Research Fellow of Research Centre For Pacific Studies, Beijing Foreign Studies University; former Trade and Investment Commissioner (China) of Pacific Islands Forum Secretariat; Vice President, United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP) Sustainable Business Network; Director of David Morris Projects OÜ; Senior Expert, China, East Asia, Australia and the Pacific, LM Prisk Political Risk & Strategic Advisory

Mr. David Morris

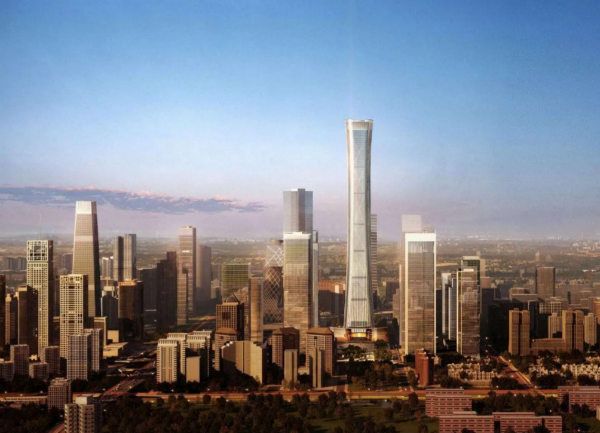

China is preparing for a leading role in the future world economic order. A closer look, therefore, at the Belt and Road Initiative and China’s new institutions and platforms for geo-economic influence can help to understand – and manage – the risks ahead.

For the last few decades the West cautiously welcomed China’s rise, as China progressively implemented its own version of the East Asian development model, a strong state but with a growing private sector, open to foreign investment and growth driven by exporting to the world. China became embedded in global supply chains and interdependent with the major economies, including the United States. While the US maintained global predominance, China’s rise posed no threat, particularly because many held the flawed expectation that China would democratise as it marketized. However, it was never going to do that while the Communist Party ruled. Indeed, its authoritarian system of governance consolidated while China’s strong growth continued.

In the last few years, the US has irrevocably switched its view, now classifying China as a strategic competitor. The new narrative is that China and the US are locked in a geopolitical contest for supremacy. Just as it contained and ultimately out-lived the Soviet Union, the US is set on a path of resisting any extension of China’s international power. In this context China’s Belt and Road, a plan to build new infrastructure links to the developing world and beyond, to reshape trade routes and supply chains, is interpreted as a geopolitical threat to the West.

The challenge is very different, though, from the challenge posed by the Soviet Union in a previous generation. The Belt and Road Initiative is – at least in theory - built on the free trade and investment principles of globalisation, a system previously supported and partly constructed the US itself. The plan includes projects for finance, technology and infrastructure such as transport, power, communications and water in developing nations. As a result, China will become the new hub for this next envisaged phase of globalisation. More than one hundred and twenty five countries have signed up for joint projects. There is a massive appetite for the economic boost it will bring, with the World Bank estimating trade in Belt and Road economic corridors is currently one third below potential and foreign investment seventy per cent below potential.

To be sure, there are risks in this ambitious program of development across a diverse range of countries. In the first few years following its announcement in 2013, Belt and Road risks were diagnosed as those confronting any infrastructure investments in the developing world – these were projects in high-risk environments, often badly governed, with corruption, poor business practices, clientelism and security problems.

Further, Chinese State-Owned Enterprises and their partners were in many cases exporting business practices that generated risks for governments and project partners. There have been examples of poor planning, lack of transparency and misunderstanding local conditions. But none of these problems were specific to the Belt and Road or, indeed, to Chinese firms.

What has changed is the growing power and influence of China itself, and that is generating anxiety and fear in the US and in many other countries. New headline risks of the Belt and Road in the last few years are bound up in the geopolitical contest between the US and China. It is claimed China’s Belt and Road will create debt traps, cyber-attacks, asset seizures, militarisation of assets and undermine the norms of the liberal international order.

China is financing the vast infrastructure projects of the Belt and Road with US dollar reserves earned from its unbalanced trade with the US, dispensed in a combination of commercial loans, concessional finance and aid. It created a new multilateral institution, the Asian Infrastructure Investment Bank. In Asia, steady development has generated a deficit of infrastructure and the new institution is an interesting test of how China might play a greater leadership role in the multilateral system in future. US fears that it would undermine the World Bank and International Monetary Fund seem, to date at least, to be unfounded. The new bank has worked closely with other financial institutions to demonstrate best practices in lending. The biggest risk of China creating a new institution seems to have been that China would do so effectively. In this respect, it challenges the norms of the previously US-led financial order.

China’s private sector firms are also making waves. Huawei has become a world leader in high speed 5G communications, the platform for transformative new technologies known as the fourth industrial revolution. Together with other Chinese tech firms, it is building a “digital silk road” to developing countries, constructing not only communications networks but facial recognition and other “smart city” applications that are feared to be building blocks of a surveillance state. In the new geopolitical contest, Huawei is claimed to be a vector for cyber espionage and potential sabotage. It has become a case study of the US push to decouple from Chinese supply chains. This is a much more difficult set of risks to evaluate. It would appear prudent to ensure a diversity of suppliers, so that no one country dominates the technology of the future.

Some of the infrastructure projects of the Belt and Road have been loaded with debt and projects in Myanmar, Malaysia and Pakistan have been downscaled or cancelled. This has fed a narrative that China is deliberately trapping nations in debt. The most quoted case is the Hambantota port in Sri Lanka, which US Vice President Pence claimed was “debt trap diplomacy” and would “soon become a forward military base” for China. On closer investigation, the story is much more complicated. Most of Sri Lanka’s debt was not to China at all, and the Sri Lankan Government of the time actively sought the deal with China Merchants Group to manage the port (in exchange for debt forgiveness). Indeed, the deal specifically excluded military uses.

A Rhodium study of forty cases of Chinese lending to 24 countries over a decade found no evidence that China was deliberately trapping countries in debt. Rather, China has agreed to significant amounts of debt rescheduling, often on favourable terms to borrowers. At a Belt and Road Forum in Beijing last year, President Xi pledged projects would be pursued according to internationally accepted rules, standards and best practices to ensure debt sustainability, as well as combatting corruption. It remains to be seen how China will respond to debt defaults as a result of the economic fallout from the Covid-19 pandemic.

To be sure, there are new risks in this new world. China is threatening the predominance of the US in the global system and therefore geopolitical contest is the new normal. China is not liberalising, its trenchant lack of transparency and its tendency to throw its weight around provoke justified fears and concerns. The question in relation to risk is always proportionate measurement, so that an appropriate management strategy can be developed. Whether China constitutes such a grave risk that the world must decouple and contain it, as some in the US claim, or whether we can learn to live with a rising China is the question of our age. For now, the Belt and Road Initiative is meeting a demonstrated need in the developing world. It may be that the best risk strategy is to assess each project on its merits, for European and other firms to find ways to collaborate and ensure best practices. For governments, finding ways to work with China within the rules and standards of international trade and investment may be a more proportionate strategy for risk management, rather than wishing China away. But much depends on the actions of China itself. We therefore must keep a clear eye. As Ronald Reagan once said, in a different era, “trust, but verify”.

Zhou Yuxiao, Ambassador for Affairs of FOCAC of the Foreign Ministry of the People’s Republic of China, reflects on the implementation of the outcomes of the last FOCAC Summit held in Beijing in 2018, the challenges incurred since and his expectations of the upcoming Senegal meeting.

We all know that multilateralism is essential to our world vision but also facing strong headwinds. However, with the new US administration in office there is a real opportunity to work for its revival even if this is not going to be an easy task. First because there are differences all over the world about how to rebuild it. Second because in a multipolar and fractured world, the geopolitical basis for multilateralism is changing. Third because Europe, like other global players in the world, will have to work in a more assertive way to advance its interests in a more transactional world.

Last month, President Xi Jinping pledged that China would become carbon neutral by 2060. This announcement could be a tipping point in the global fight against climate change. It will accompany European efforts in the field of climate diplomacy.

It's a hard time, and everyone's feeling it in different ways. And I know a lot of folks are reluctant to tune into a political convention right now or to politics in general. Believe me, I get that. But I am here tonight because I love this country with all my heart, and it pains me to see so many people hurting.I've met so many of you. I've heard your stories. And through you, I have seen this country's promise. And thanks to so many who came before me, thanks to their toil and sweat and blood, I've been able to live that promise myself.